- User ID

- 455

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ASX and general share trading advice thread

Thankyou for your patience! Server upgrades were successful.

- Thread starter Anoma

- Start date

Please join our community to continue reading

or

Dr.Clones

Baked

- User ID

- 5964

lol how much you blanked everything outView attachment 66152boring old Asx stocks pay out big to if ya time ya entries trim on peaks accumulate on dips and read business quarterly reports there's more then one macro playing out atm bitcoin is jist one way there and it's not guaranteed by any means

- User ID

- 455

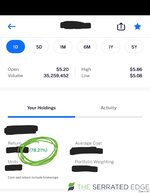

See that’s the thingThat’s my bitcoin statistics

View attachment 66151

I don’t need a halving cycle and a bull narrative to cash out.

I can pull 70–80% off boring Aussie tickers while still holding the bag long term.

You’re basically at the roulette table waiting for Bitcoin to land on green, I’m just clipping steady dividends and stacking capital regardless

- User ID

- 455

I showed what was relevantlol how much you blanked everything out

- User ID

- 455

There's enough there to be able to reverse engineering what stock it is but I'm not comfortable spraying my financials that's my edge...

Dr.Clones

Baked

- User ID

- 5964

Problem is you’re stacking government money. Government money goes down in value not up the purchasing power of the Almighty dollar has dropped significantly. Bitcoin purchased him power however will only go up mark my word.See that’s the thing

I don’t need a halving cycle and a bull narrative to cash out.

I can pull 70–80% off boring Aussie tickers while still holding the bag long term.

You’re basically at the roulette table waiting for Bitcoin to land on green, I’m just clipping steady dividends and stacking capital regardless

- User ID

- 455

Translation; math doesn't add up so I'll pivot to the dollars failing... crypto creeProblem is you’re stacking government money. Government money goes down in value not up the purchasing power of the Almighty dollar has dropped significantly. Bitcoin purchased him power however will only go up mark my word.

Come on dude...

- User ID

- 455

Funny how when some one puts a microscope on bitcoin or crypto all of a sudden its a TED talk on fiat collapse....

Dr.Clones

Baked

- User ID

- 5964

- User ID

- 455

- User ID

- 455

Last time I checked markets respond to mathematics not sermons....

- User ID

- 455

U do u man but telling ppl to just blindly invest in bitcoin is jist reckless IMHO

Markets r ruthless...

Markets r ruthless...

Dr.Clones

Baked

- User ID

- 5964

Sound money is a currency that preserves its purchasing power over time, resisting inflation and arbitrary devaluation to enable stable economic planning and long-term savings, often exemplified by gold-backed systems.

Hard money, closely related, is a scarce, asset-backed form like gold or Bitcoin with a fixed supply that’s durable and resistant to overproduction, promoting fiscal discipline, trust, and economic stability by preventing wealth dilution through unlimited printing

Hard money, closely related, is a scarce, asset-backed form like gold or Bitcoin with a fixed supply that’s durable and resistant to overproduction, promoting fiscal discipline, trust, and economic stability by preventing wealth dilution through unlimited printing

Dr.Clones

Baked

- User ID

- 5964

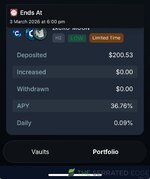

I just set up a 36% APY vault forU do u man but telling ppl to just blindly invest in bitcoin is jist reckless IMHO

Markets r ruthless...

moon and ZKCRO now that to me seems reckless but it says it’s a low risk so here we go it’s in USD

And I never told people to blindly invest. I’ve shared heaps of Memes and pictures about bitcoin lots of education going on here.

You guys stick to your fiat government money it’ll go up in value

Last edited:

Dr.Clones

Baked

- User ID

- 5964

Summary of The Bitcoin Standard by Saifedean Ammous

Published in 2018, The Bitcoin Standard: The Decentralized Alternative to Central Banking is an economic treatise that traces the history of money from ancient commodities to modern fiat currencies, arguing that Bitcoin represents the pinnacle of “sound money”—a form resistant to debasement and government control. Ammous, an economist and Bitcoin advocate, uses historical analysis to critique the flaws of unsound money systems and positions Bitcoin as a superior, decentralized alternative that could foster long-term societal prosperity.

The Evolution of Money and the Rise of Sound vs. Unsound Systems

The book begins by exploring money’s origins as a tool for exchange, selected based on “salability”—its divisibility, portability, and ability to store value over time, often measured by the stock-to-flow ratio (existing supply divided by annual production). Early societies experimented with items like shells, beads, and livestock, but these failed due to low salability. Precious metals, particularly gold, emerged as the dominant “commodity money” because of their scarcity, durability, and high stock-to-flow ratio, enabling global trade and innovation during the 19th-century gold standard era. However, gold’s centralization in banks made it vulnerable to dilution, leading to the abandonment of the gold standard after World War I in favor of fiat money—government-issued currency backed only by decree. This shift introduced “unsound money,” prone to inflation and manipulation, which Ammous links to economic instability, recessions, and even wars, as governments print money to fund deficits without accountability.

The Societal Impacts of Unsound Money: Time Preference and Economic Distortions

Ammous introduces the concept of “time preference,” the trade-off between present and future value, arguing that unsound money raises it by eroding savings through inflation, encouraging short-term consumption, debt, and low productivity. Under fiat systems influenced by Keynesian and monetarist economics, central banks distort price signals—essential market mechanisms for resource allocation—leading to boom-bust cycles. This “scam of modernity,” as Ammous calls it, not only stifles innovation (contrasting the gold era’s inventions like electricity with modern stagnation) but also fuels conflict by enabling unchecked government spending on wars and tyranny. Sound money, conversely, lowers time preference, promoting saving, capital accumulation, and peaceful cooperation, even influencing cultural outputs like art.

Bitcoin as the Ultimate Sound Money: A Monetary Lifeboat

The book’s second half champions Bitcoin, introduced in 2008 by the pseudonymous Satoshi Nakamoto as a “peer-to-peer electronic cash” system. Powered by blockchain technology—combining distributed networks, hashing, digital signatures, and proof-of-work mining—Bitcoin achieves perfect salability: divisible to eight decimal places, instantly transferable globally without intermediaries, and capped at 21 million units for absolute scarcity. Unlike gold, its digital nature prevents confiscation or destruction, offering individual sovereignty and counterparty-free international settlement. Ammous highlights Bitcoin’s four key strengths: as an unmatched store of value (with an ever-increasing stock-to-flow ratio approaching infinity), a tool for personal financial independence, a neutral global settlement layer, and a potential unit of account if volatility subsides with adoption. While acknowledging challenges like price swings and scalability (which may require layered solutions or even Bitcoin-backed currencies), Ammous sees it as immune to the manipulations plaguing fiat, potentially restoring a new gold-standard-like era of stability.

In conclusion, The Bitcoin Standard warns that fiat money’s flaws—debasement, centralization, and incentives for short-termism—threaten civilization’s progress, but Bitcoin offers a “monetary lifeboat” for escaping this cycle. By decentralizing control and enforcing scarcity through code, it could lower time preferences, boost productivity, and promote global peace, making it not just a cryptocurrency, but the foundation for sound money in the digital age. The book blends economics, history, and philosophy to make a compelling, if Bitcoin-centric, case for monetary reform.

Published in 2018, The Bitcoin Standard: The Decentralized Alternative to Central Banking is an economic treatise that traces the history of money from ancient commodities to modern fiat currencies, arguing that Bitcoin represents the pinnacle of “sound money”—a form resistant to debasement and government control. Ammous, an economist and Bitcoin advocate, uses historical analysis to critique the flaws of unsound money systems and positions Bitcoin as a superior, decentralized alternative that could foster long-term societal prosperity.

The Evolution of Money and the Rise of Sound vs. Unsound Systems

The book begins by exploring money’s origins as a tool for exchange, selected based on “salability”—its divisibility, portability, and ability to store value over time, often measured by the stock-to-flow ratio (existing supply divided by annual production). Early societies experimented with items like shells, beads, and livestock, but these failed due to low salability. Precious metals, particularly gold, emerged as the dominant “commodity money” because of their scarcity, durability, and high stock-to-flow ratio, enabling global trade and innovation during the 19th-century gold standard era. However, gold’s centralization in banks made it vulnerable to dilution, leading to the abandonment of the gold standard after World War I in favor of fiat money—government-issued currency backed only by decree. This shift introduced “unsound money,” prone to inflation and manipulation, which Ammous links to economic instability, recessions, and even wars, as governments print money to fund deficits without accountability.

The Societal Impacts of Unsound Money: Time Preference and Economic Distortions

Ammous introduces the concept of “time preference,” the trade-off between present and future value, arguing that unsound money raises it by eroding savings through inflation, encouraging short-term consumption, debt, and low productivity. Under fiat systems influenced by Keynesian and monetarist economics, central banks distort price signals—essential market mechanisms for resource allocation—leading to boom-bust cycles. This “scam of modernity,” as Ammous calls it, not only stifles innovation (contrasting the gold era’s inventions like electricity with modern stagnation) but also fuels conflict by enabling unchecked government spending on wars and tyranny. Sound money, conversely, lowers time preference, promoting saving, capital accumulation, and peaceful cooperation, even influencing cultural outputs like art.

Bitcoin as the Ultimate Sound Money: A Monetary Lifeboat

The book’s second half champions Bitcoin, introduced in 2008 by the pseudonymous Satoshi Nakamoto as a “peer-to-peer electronic cash” system. Powered by blockchain technology—combining distributed networks, hashing, digital signatures, and proof-of-work mining—Bitcoin achieves perfect salability: divisible to eight decimal places, instantly transferable globally without intermediaries, and capped at 21 million units for absolute scarcity. Unlike gold, its digital nature prevents confiscation or destruction, offering individual sovereignty and counterparty-free international settlement. Ammous highlights Bitcoin’s four key strengths: as an unmatched store of value (with an ever-increasing stock-to-flow ratio approaching infinity), a tool for personal financial independence, a neutral global settlement layer, and a potential unit of account if volatility subsides with adoption. While acknowledging challenges like price swings and scalability (which may require layered solutions or even Bitcoin-backed currencies), Ammous sees it as immune to the manipulations plaguing fiat, potentially restoring a new gold-standard-like era of stability.

In conclusion, The Bitcoin Standard warns that fiat money’s flaws—debasement, centralization, and incentives for short-termism—threaten civilization’s progress, but Bitcoin offers a “monetary lifeboat” for escaping this cycle. By decentralizing control and enforcing scarcity through code, it could lower time preferences, boost productivity, and promote global peace, making it not just a cryptocurrency, but the foundation for sound money in the digital age. The book blends economics, history, and philosophy to make a compelling, if Bitcoin-centric, case for monetary reform.

Dr.Clones

Baked

- User ID

- 5964

Ohhh what did you doCongrats doc. You got an account upgrade